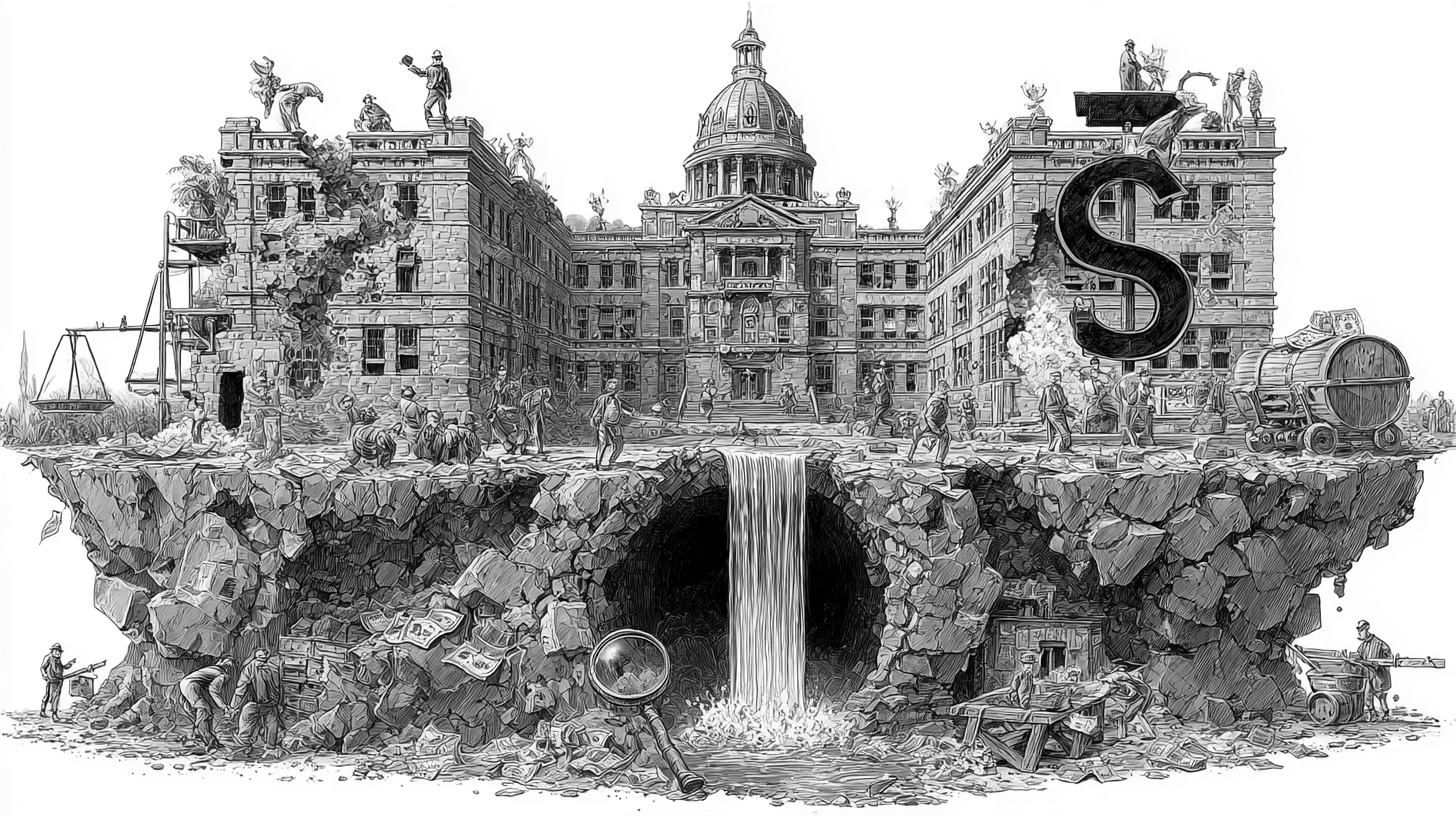

Y Combinator's Spring 2026 Request for Startups includes a category that caught our attention: government fraud investigation. Specifically, they highlight the qui tam provision under the False Claims Act, which allows private citizens to file lawsuits on behalf of the government to recover fraudulently obtained funds.

The numbers are staggering. Medicare alone loses tens of billions of dollars annually to fraud. The Coalition Against Insurance Fraud estimates total insurance fraud at $308.6 billion per year in the US. Government programmes -- workers' compensation, disability, Medicare, Medicaid, defence procurement -- represent a massive and growing portion of that figure.

YC's thesis is that this process should be accelerated with software. We think they are right, and we think the technology required is closer to production than most people realise.

Why government fraud is getting worse

Government fraud has always been large. What is changing is the attack surface. Generative AI has made it trivially easy to fabricate the kind of evidence that government claims rely on: medical records, diagnostic images, injury photographs, property damage documentation, receipts, invoices, and identity documents.

A fraudulent Medicare claim used to require a network of conspirators -- corrupt providers, fabricated patient records, coordinated billing. Now a single person with a laptop can generate synthetic medical images, fabricate patient documentation, and submit claims through legitimate billing channels. The barrier to entry for fraud has collapsed.

Government agencies are particularly vulnerable because their systems were built for scale, not scrutiny. They are designed to process millions of claims efficiently, not to forensically examine every piece of submitted evidence. When you optimise for throughput, you create gaps that sophisticated fraud exploits.

The qui tam angle

The False Claims Act's qui tam provision is unusual and powerful. It allows a private party -- the "relator" -- to file a lawsuit on behalf of the government against entities that have defrauded government programmes. If the case succeeds, the relator receives a percentage of the recovered funds, typically 15-30%.

YC sees an opportunity to build software that helps identify and substantiate these claims at scale. The logic is straightforward: if you can systematically detect fraudulent submissions to government programmes, you can generate revenue through qui tam recoveries while simultaneously reducing fraud losses.

The alignment of incentives is compelling. The government recovers stolen funds. The relator earns a percentage. The software company enables the detection at scale. Everybody wins except the fraudster.

Why this connects to what we are building

At deetech, we are building AI forensic media verification for insurance. The core capability -- detecting synthetic, manipulated, or fabricated visual evidence in claims submissions -- is directly transferable to government fraud.

The technical challenge is similar. Government claims involve the same types of evidence: photographs, scanned documents, medical imaging, identity documents. The evidence is similarly degraded -- compressed, converted between formats, processed through legacy systems. The detection requirements are similar: you need to identify synthetic content reliably in messy, real-world data, and you need to produce evidence that meets legal evidentiary standards.

The evidentiary standards point is critical. Qui tam cases end up in federal court. You cannot bring a case based on a confidence score from a black-box model. You need explainable findings -- visual heatmaps showing exactly where manipulation was detected, technical documentation of the methodology, and evidence that can withstand cross-examination. This is exactly the kind of output deetech is designed to produce for insurance investigations.

The market structure favours specialists

Government fraud detection today is dominated by legacy players running rules-based systems on structured claims data. They look at billing patterns, provider networks, and statistical anomalies in claims volumes. This catches the obvious fraud -- the provider billing for procedures they did not perform, the patient who appears in two states simultaneously.

What it does not catch is fabricated evidence. A fraudulent claim with synthetic medical images, AI-generated damage photographs, or manipulated diagnostic records will pass every rules-based check. The structured data looks legitimate because the structured data is legitimate -- it is the supporting evidence that is fabricated.

This is the same gap we identified in insurance. The fraud detection layer checks the numbers. Nobody checks the images. The numbers are easy to fake consistently. The images are where the forensic signal lives.

The scale of the opportunity

Government spending on healthcare alone exceeds $2 trillion annually in the US. Fraud estimates range from 3% to 10% of total spend, putting losses in the range of $60-200 billion per year. Workers' compensation adds another $34 billion in annual fraud. Disability fraud, defence procurement fraud, and other government programmes push the total higher still.

The qui tam mechanism means that a company identifying fraud does not need to sell software to the government (a notoriously slow process). It can partner with law firms and relators, provide the detection technology, and share in the recovery. The revenue model is outcome-based: you get paid when fraud is recovered, not when software is licensed.

This is a different business model from selling SaaS to insurers, but the underlying technology is the same. The forensic media analysis, the explainable evidence, the ability to handle degraded real-world data -- all of it transfers.

What we are watching

We are not announcing a government fraud product. deetech is focused on insurance, and focus is what makes ventures work. But we are paying close attention to how the qui tam ecosystem develops, because the technical capabilities we are building map directly to the problem YC has identified.

The pattern we see is this: AI forensic media verification is a horizontal capability that can be applied vertically. Insurance is our beachhead because it has clear buyers, quantifiable losses, and a regulatory environment that is creating urgency. Government fraud is a natural adjacency -- same evidence types, same degradation patterns, same need for court-ready output, much larger total addressable market.

YC is right that the government fraud problem is massive, underserved, and ripe for AI-powered solutions. The teams that crack it will need exactly the kind of forensic detection capability that we are building. Whether that team is us, or someone we enable, the opportunity is real and the timing is now.